Top 10 Homeowners Insurance Companies

The top home insurance companies are State Farm, Allstate, and Liberty Mutual, according to NAIC data. State Farm dominates over 18 percent of the market share, with Allstate coming in second with 8.4 percent. Just because the top ten homeowners insurance companies are the biggest doesn’t mean they have the best rates. Enter your ZIP code below to find the most affordable insurance quotes in your state.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

CEO and CFP®

Joel Ohman is the CEO of a private equity-backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

CEO and CFP®

UPDATED: Sep 14, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Sep 14, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

In 2017 (the latest year for which data is available), State Farm was the top homeowner’s insurance company, based on direct insurance premium written, per NAIC data.

The well-known company, which is also the leading auto insurance company, wrote $17.6 billion in homeowner’s insurance throughout the year while claiming a staggering 18.6% of total market share.

Allstate was a distant second with nearly $8 billion in premium written, helping it gather 8.4% of the nation’s market share.

Rounding out the top three was Liberty Mutual, which wrote about $6.5 billion in homeowner’s insurance for 6.9% market share.

What are the top ten homeowner’s insurance companies?

- State Farm (18.6% market share)

- Allstate (8.4% share)

- Liberty Mutual (6.9%)

- USAA (6.1%)

- Farmers (6.0%)

- Travelers (3.8%)

- Nationwide (3.5%)

- American Family (3.2%)

- Chubb (2.9%)

- Erie (1.7%)

Chances are you’ve heard of most of these companies, give or take with the last few.

They are household names and advertise a lot, which explains why they are so popular and dominant in the insurance space.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why does biggest not always equal best?

However, keep in mind that these homeowners insurance companies aren’t necessarily the best in terms of customer satisfaction or pricing, but rather the largest operating in the country, per NAIC data.

You should also look at insurance company ratings and inquire with your State Department of Insurance to ensure the company you ultimately choose to obtain coverage with is sound financially.

It also may not hurt to read an objective review or two, or simply brush up on the company’s history to determine if they’re the right fit for you.

Remember, the biggest company certainly isn’t the best, and if they’re advertising heavily on television, they may have to charge you more for your insurance coverage to compensate, even for a standard home insurance policy.

Read more:

Unsurprisingly, some of the largest home insurance companies are also the most expensive, despite failing to top the ranks of customer satisfaction surveys and being high in consumer complaints. The cost of homeowners insurance will vary based on what homeowners policy you choose, as well as other factors, like mortgage rates and state laws. Be sure to shop around for some sample quotes and browse different types of coverage available to you to see insurance costs. Whether you own several high-value properties, high-value items, or you’re in need of basic coverage for personal property, it is important to look at your options before deciding on a homeowners insurance policy. (For more information, read our “How Much Homeowner’s Insurance Do I Need?“)

[How are homeowners insurance rates determined?]

How do the top homeowner’s insurance companies compare in terms of customer satisfaction?

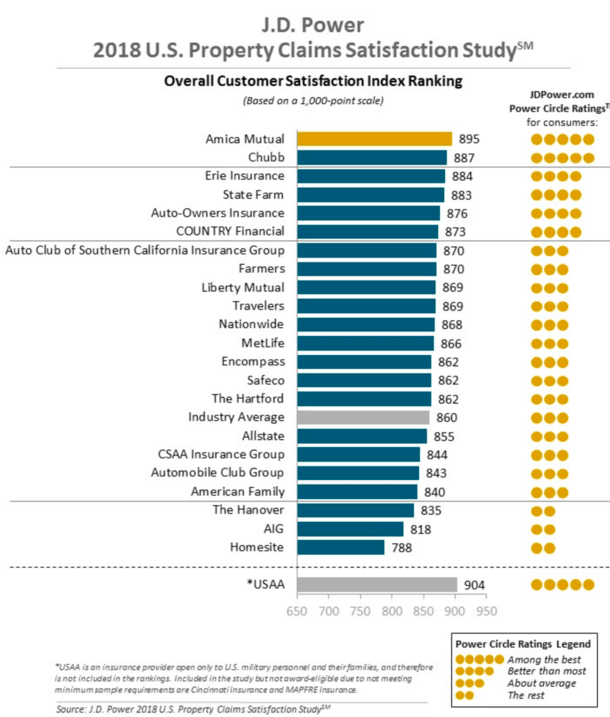

As you can see from the chart above, Amica Mutual was the top homeowner’s insurance company in 2018 in terms of satisfaction (per J.D. Power), which is certainly more important than size, assuming they’re financially sound.

They topped the chart for the seventh consecutive year, despite not being a top-10 insurer in terms of overall volume. This is a great example of how the largest insurers aren’t always the best at giving the most optimal customer experience.

And Chubb and Erie ranked second and third for property claims satisfaction while only mustering a ninth and 10th spot on volume list, respectively.

State Farm performed relatively well by claiming the fourth spot, but Allstate, Liberty Mutual, and Travelers scored just average in customer reviews.

Which makes you wonder why consumers might be paying more for such coverage. The largest insurance companies aren’t known for providing the most affordable rates, or for having the best customer service, insurance reviews, or financial rating. There is definitely something to be said for brand notoriety and familiarity for these companies and their success. (For more information, read our “Top Ten Insurance Companies in the United States“)

For the record, USAA scored the highest of all the companies, but isn’t actually included in the J.D. Power rankings because it’s reserved for U.S. military and their families only.

If you’re looking for homeowner’s insurance, consider gathering insurance quotes online and/or speaking with an independent insurance agent to explore all your options and gain an understanding of the average cost and standard policies. Be sure to ask about any policy discounts! (For more information, read our “Top 10 Lies Told By Insurance Agents and Their Customers“)

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

CEO and CFP®

Joel Ohman is the CEO of a private equity-backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

CEO and CFP®

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.