Largest Insurance Companies in the World

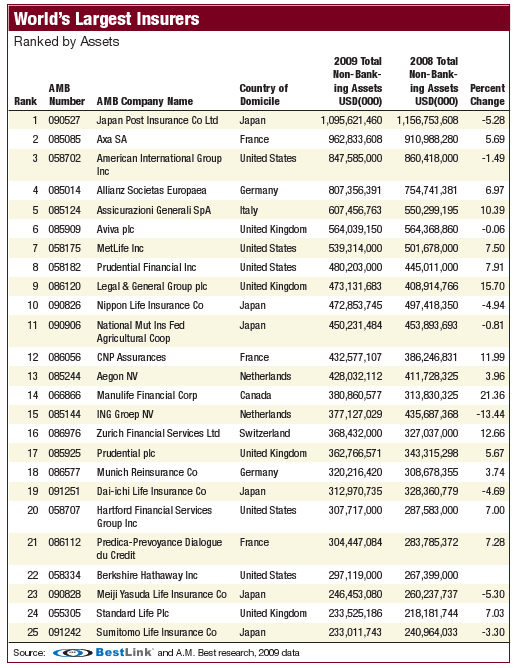

According to A.M. Best, the largest insurance companies in the world are Japan Post Insurance, Axa SA in France, and U.S.-based AIG. A total of five U.S. insurers made the top 25 list of the largest insurance providers in the world, including Hartford Financial Services Group, Inc and Warren Buffet’s Berkshire Hathaway, which includes GEICO.

Read moreFree Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Bigger is better, right?

Many of us choose to buy insurance from the largest insurers because it gives us piece of mind. We think they’re too big to fail. So we have confidence that they’ll be there when we need them. On a more immediate basis, companies with a wider market share can spread the risk. This enables them to offer lower prices and tolerate more problems for high-risk insureds.

The more money our insurance company has, the better the odds they’ll be able to pay our insurance claims if anything goes wrong. It’s also less likely that the larger insurance companies will have to make big changes after a natural disaster to stay afloat in the insurance industry.

This line of thinking isn’t necessarily wrong, but it should be no surprise that insurance companies, in general, are typically financially sound. It’s not unheard of for smaller insurance companies to go out of business, but they generally stay afloat by underwriting more conservatively from the start.

Admitted insurers financials, those licensed to conduct business in any particular state by individual state departments of insurance, are heavily scrutinized to ensure they remain solvent before anything happens. So whatever an insurance company’s size, they have to meet certain standards to sell. Should they become insolvent, they still have to meet set standards while going out of business to ensure customers have sufficient opportunity to find a new insurer.

Read More: Best Business Insurance Companies

It is very difficult to operate an insurance company in a manner that might lead to an inability to pay claims…although it has happened from time to time.

Furthermore, large insurers are not free from financial woes.

Does anyone remember AIG’s financial problems in 2008? They were one of the largest American insurance companies out there…and almost lost it all.

Are the world’s largest insurance companies ranked higher by J.D. Power?

Companies like J.D. Power and AM Best offer more insight into the money side of things. While size is not a guarantee of financial stability, many of the larger insurance corporations do have a better outlook. AM Best (insurance company ratings) recently released their list of the world’s largest insurers in 2009 (the most recent data available), ranked by assets. (For more information, read our “How do insurance companies make money?“)

These rankings do not evaluate the insurers by the number of policies they have in-force or by customer satisfaction rankings. While there may be some confusion about what sites like J.D. Power does, insurance companies with high financial rankings tend to also perform well in other areas. After all, if they didn’t pay claims, provide reasonable customer service, etc., customers would leave them taking their profitability with them.

Let’s look at a few of the highlights of the list.

Topping the list is a Japanese company, Japan Post Insurance Co Ltd, with $1,095,621,460,000 in assets. Yes, you are reading that correctly…Japan Post has over one trillion dollars in assets.

Believe it or not, that total is actually down 5.28 percent from the previous year. Still not too shabby.

A French company, Axa SA, snagged the second spot with slightly less than one trillion dollars in assets.

Their 2009 balance sheet revealed a 5.69 percent increase from 2008, with $962,833,608,000 in assets.

American International Group, Inc (AIG) was the largest U.S insurance company, and the third largest in the world. AIG offers auto, home, life, and a wide range of other insurance products to the average American family. AIG isn’t always the cheapest insurance policy. Berkshire Hathaway Inc’s Geico is typically known for the cheapest auto insurance prices. But AIG’s network is much larger.

Rounding out the top five were MetLife, Inc and Prudential Financial, Inc, the only other two insurers from the United States to make it into the top ten, with $539,314,000,000 and $480,203,000,000, in assets, respectively.

A total of five U.S. insurers made the top 25 largest insurers in the world, including Hartford Financial Services Group, Inc and Warren Buffet’s Berkshire Hathaway (which includes Geico).

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.