Top 10 Workers Compensation Insurance Companies in Texas

This list of the top ten workers' compensation insurance companies in Texas aren't necessarily the top-rated, but they are the most frequently used. Texas Mutual, Liberty Mutual, and AIG are the most commonly used worker’s comp companies in Texas. If you need workers’ compensation insurance, use our free insurance tool below to get in touch with an agent today.

Read moreFree Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Even if you’re running a small business, a single serious worker accident could have lasting effects. It could even put you out of business. Depending on your business, you might be required to carry coverage under federal law.

If you’re currently looking for a workers’ compensation insurance company in Texas, you may be wondering who the top players are. Which companies have the experience and the financial stability to pay claims and protect your interests. In some industries, it’s also about avoiding unnecessary staffing shortages.

Fortunately, such information is compiled and delivered by the Independent Insurance Agents of Texas. Keep in mind, this is based on numbers and compensation benefits. It doesn’t necessarily cover consumer satisfaction or their compensation policy and how difficult it makes the claims process after a workplace injury.

Just keep in mind that biggest isn’t always best, and that insurance company ratings vary amongst the largest insurance companies.

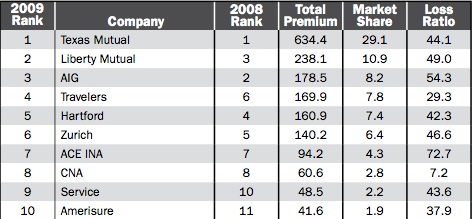

Let’s take a look at the list of the top workers’ compensation insurance companies in Texas, based on written insurance premium.

Who are the top insurers in Texas for workers compensation coverage?

Read More: Top Ten Insurance Companies in the United States

As you can see, Texas Mutual was the top workers’ compensation provider in Texas by a landslide in 2009 (the most recent data available), which isn’t much different than 2008, according to the IIAT Special Report.

Texas Mutual grabbed 29.1% market share with $634.4 million in written premium, followed by Liberty Mutual, who snagged 10.9% market share with $238.1 million in written premium.

Heavy-hitter AIG claimed the third spot with 8.2% market share and $178.5 million in written premium, followed closely by The Travelers, with 7.8% market share and $169.9 million in written premium.

Rounding out the top five was The Hartford, with 7.4% market share and $160.9 million in written premium; just slightly below Travelers.

A number of other notables were in the top 20, including Zurich, CNA, Chubb, Old Republic, and Employers. With many Texas workers in physically demanding and high risk vocations, medical benefits and sometimes death benefits are key. Depending on the injury, waiting a few days or weeks to settle a claim could lead to permanent disability.

Unlike the results for commercial auto insurance providers in Texas, workers’ compensation insurance is more profitable than the U.S. national average.

If you’re in need of workers compensation insurance or simply want to be certain you’re getting a good deal on your current policy, contact a local independent insurance agent for multiple quotes. (For more information, read our “Top 10 Lies Told By Insurance Agents and Their Customers“)

Where can you get auto insurance quotes?

Whether you’re looking for personal or commercial auto insurance, you can get property coverage and medical care. It starts with entering your zip code and answering a few questions to find an insurance carrier that serves your zip code.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.