Foreclosed Homeowners Insurance Becoming More Difficult to Obtain

Foreclosed homeowners insurance is becoming more difficult to obtain due to the potential risks, one of which is obtaining reasonably priced homeowners or rental property insurance. More and more insurance companies will now add questions to their policy applications dealing with foreclosed homes, short sales, and all-cash purchases, which can make it more challenging to find foreclosed home insurance.

Read moreUPDATED: Dec 10, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Dec 10, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 10, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Dec 10, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

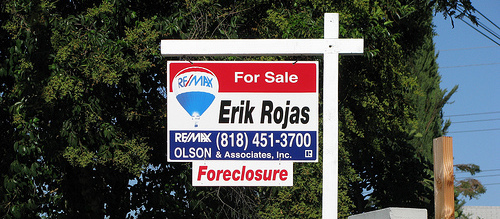

You would have to live under a rock to not be aware of the mounting home foreclosures and short sales flooding the American real estate market and driving down home values nationwide.

Foreclosed homes and short sales can be a great way to purchase that dream home or get in on a long term investment, and both individuals and groups of investors often purchase these homes at deep discounts to current market value.

However, there are many potential downside risks associated with purchasing these homes, one of which is obtaining reasonably priced homeowners or rental property insurance, also referred to as a dwelling fire policy.

Insurance companies are beginning to adjust their guidelines for the eligibility of these properties and their premium rating structure for property risks they will accept.

Of course, the adjustments are to the up-side.

Why the Change?

Many insurers are recognizing an escalating claim trend associated with foreclosed homes. This is leading to their change in attitude regarding appetite for these risks and how much insurance premium they need to charge to remain profitable in this segment.

Insurance companies realize profit by investing premium income and by earning a premium surplus. The latter being achieved by charging their insured enough premium to pay covered claims and operating expenses and having capital left over.

The insurance industry is among the most competitive in the world due to the potential for profit. There is a delicate balance between offering premiums low enough to attract business and turning a profit. The margin is often slim.

Insurers are quick to review loss data for trends on claims in order to accurately price their insurance. As a result of this business model, insurers are quick to act when a particular segment of business is trending towards unprofitability.

What Types of Claims Are Increasing?

As discussed above, insurers are seeing an increase in insurance claims associated with foreclosed and short sale homes. In particular, there is an increase in property damage claims being filed within the first 30 days of the insurance policies being issued.

Many of the homes are purchased sight-unseen, which increases the chance that property damage has occurred prior to the purchase of the home.

It is also common for individuals who lose a home to foreclosure or short sale to purposefully damage the property before they are forced to vacate the premises as a means to inflict financial harm on the institution who forced the foreclosure proceedings.

Insurance companies believe the claims filed almost immediately after a policy is issued are a result of the homes being in general disrepair due to lack of maintenance or intentional damage from previous owners.

Let’s look at an example:

The home is purchased and insurance coverage is obtained. The new homeowner takes possession of the property, and upon inspection, determines the home has water leaks or damage to the interior walls, flooring, fixtures or cabinetry and opts to file a claim on their new insurance policy to have repairs made at almost no out-of-pocket cost, assuming the policy deductible is reasonable.

Insurers may be limited in their ability to deny or limit claim payments as the exact date and time the property damage occurred may be hard to pin down. This situation results in insurance companies having to pay claims that are not typical of other homes of like kind and quality.

These types of losses are difficult to “price” accordingly, as the insurers base their premiums on historical loss data, which certainly wouldn’t be reflective of this increasing occurrence.

What to Expect When Shopping For a Policy?

More and more insurance companies will now add questions to their policy applications dealing with foreclosed homes, short sales and all-cash purchases.

Today, it’s possible to purchase homeowners insurance over the phone or via the internet, which make the process simple and timely. But you may experience a delay in policy issuance as the insurers will likely demand an underwriting review of the policy prior to offering coverage. (For more information, read our “The Five Most Common Homeowners Insurance Claims“).

Read more: Types of Homeowners Insurance

Standard insurers may decide to limit available coverage on previously foreclosed homes and short sale properties, require increased property damage deductibles, or even decide not to insure these types of risks.

All of these potential changes may lead to increased premiums for anyone seeking to insure these types of properties, so be warned.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.