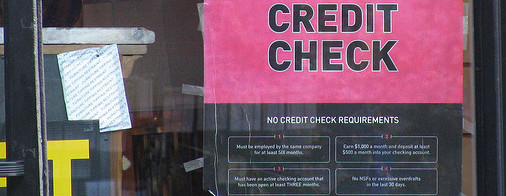

Do insurance companies check credit?

Depending on where you live, insurance companies will check credit. In some states, it is illegal for providers to check credit scores. Insurers do not use your actual FICO score as a rating factor in determining your premiums. They are only interested in your payment history, which they can also obtain via your insurance score. Scroll down to learn how credit scores can impact car insurance rates.

Read moreUPDATED: Sep 15, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Sep 15, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Sep 15, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Sep 15, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Doesn’t it seem like your credit score affects almost every aspect of your life nowadays? If you feel this way, you’re not crazy.

More and more insurance companies are looking at certain aspects of your financial history when deciding how much you charge for your insurance premium.

How Do Insurance Companies Get My Credit Score?

Your insurer or independent agent likely asked you for your social security number when filling out your application for coverage. This is the best way to get access to your financial history. (For more information, read our “Independent Agent vs. Captive Agent“).

Additionally, unbeknown to the average insurance consumer, you financial history can be accessed by simply using your name and current address, as long as you have been there for at least one year (in most cases).

What Do They Do With My Information?

Insurers do not use your actual FICO score as a rating factor in determining your insurance premium. Insurers could care less how many credit cards you have or what the balances are. Rather, they are only interested in your payment history, which they can obtain via your insurance score of financial responsibility scores.

Read More: Pay Your Insurance Bills with a Credit Card to Earn Lots of Miles and Points

Several controversial studies have concluded that there is a correlation between your financial responsibility level and your propensity to file an insurance claim.

Individuals who file claims have to pay more for their insurance and vice versa…bottom line.

Whether you are a 16-year old driver, have several tickets or accidents, or a poor financial history, you can expect your premium to be higher than an individual with none or fewer of those characteristics.

Does Every Insurance Company Check Credit?

Not every insurance company uses your financial history to determine your insurance premium. In fact, some insurers are specifically “going after” drivers and homeowners with poorer payment histories. You can expect to pay more for those insurance policies though…

There are also some states that do not allow insurance companies to use financial history as a rating factor. California is an example of one such state. No matter what your credit history, your premium will be determined using more conventional rating factors such as age, sex and the type of vehicle you drive (how are car insurance rates determined?).

Read More: What is premium financing?

Am I Out of Luck If I Have Bad Credit?

Not necessarily. There are several discounts (good student, good driver) available on today’s insurance policies. So, even if you have a poor credit history, you may qualify for certain discounts which may effectively even out your premium.

Tip: How to get cheap car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.