Post

PostClearcover Car Insurance Review (2026)

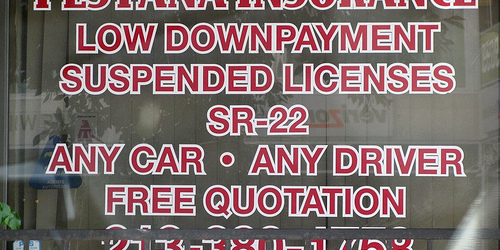

Costs are on the rise, including car insurance. Why is insurance so expensive and how can you get lower rates? Clearcover car insurance might be the answer for you. Although Clearcover car insurance is pretty new, rates are lower than average largely due to the streamlined approach and low overhead. While many drivers find affordable...

Costs are on the rise, including car insurance. Why is insur...