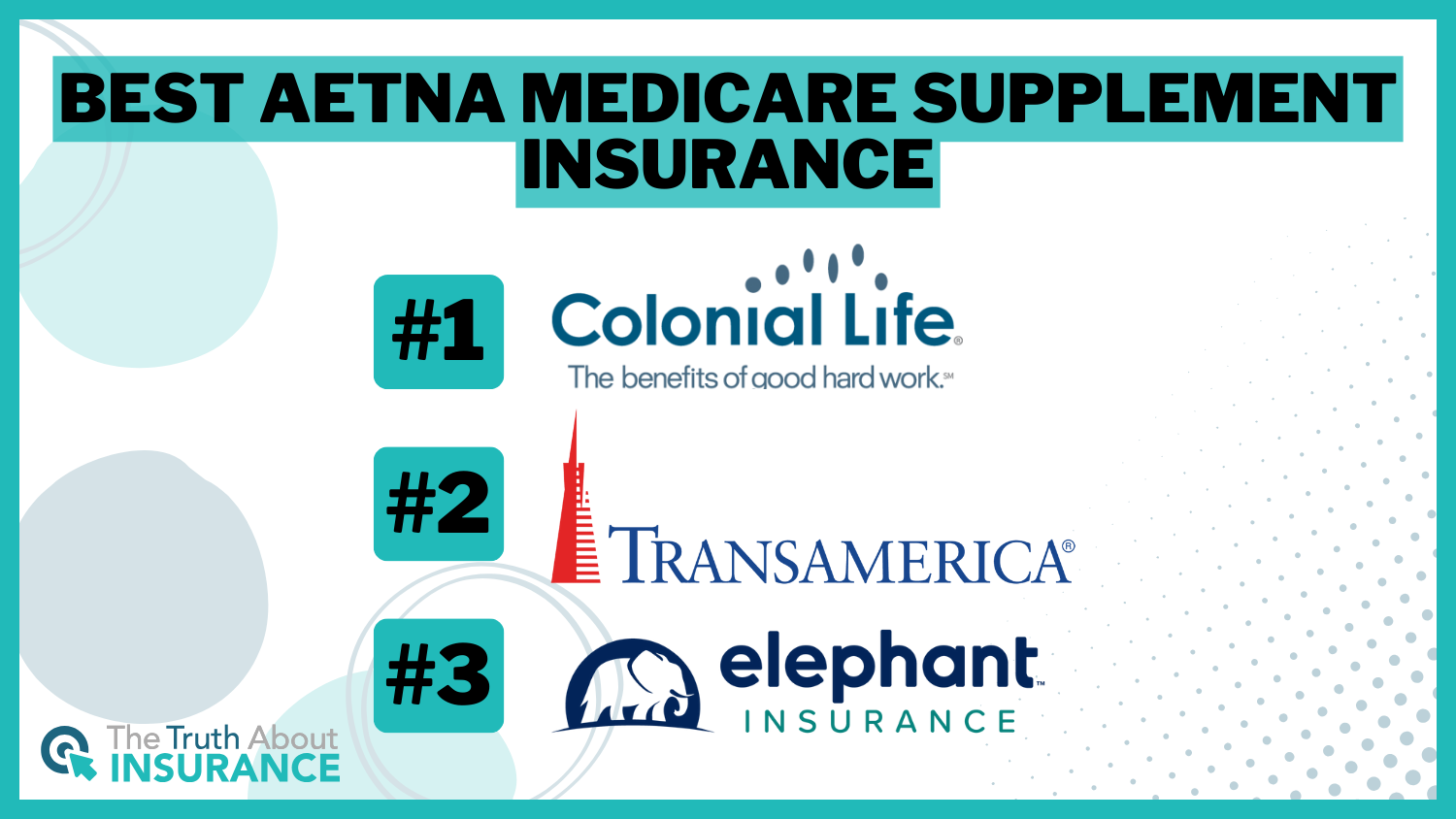

Best Aetna Medicare Supplement Insurance in 2025 (Top 8 Companies Ranked)

Colonial Life, Transamerica, and Elephant offer the best Aetna Medicare supplement insurance, beginning at $82 monthly. These prominent health insurance companies fill temporary coverage needs and provide comprehensive plans at competitive prices, attracting individuals seeking savings and assurance.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: May 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: May 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Aetna Medicare Supplement

A.M. Best Rating

Complaint Level

Company Facts

Full Coverage for Aetna Medicare Supplement

A.M. Best Rating

Complaint Level

- Colonial Life offers liability protection coverage at $82 per month

- Explore top-rated Aetna Medicare supplement insurance providers

- Use expert reviews to select the best fit for your health needs

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Colonial Life: Top Overall Pick

Pros

- Flexible Coverage Options: Colonial Life provides a wide range of supplemental health insurance plans for customized protection.

- Individualized Assistance: With an extensive network of agents, Colonial Life offers personalized guidance to policyholders.

- Strong Financial Standing: As highlighted in our Colonial Life insurance review, their solid reputation ensures reliability and stability for policyholders.

Cons

- Restricted Online Functionality: Online tools provided by Colonial Life may lack advanced features, limiting user experience.

- Price Considerations: Premiums, particularly for supplemental health insurance, may be comparatively higher with Colonial Life.

#2 – Transamerica: Best for Health Solutions

Pros

- Financial Stability: Transamerica guarantees the fulfillment of long-term commitments such as policy payouts.

- Tailored Policies: As per our Transamerica insurance review, they provide customizable coverage options that cater to individual requirements.

- Superior Customer Service: Transamerica consistently provides exceptional support to its customers.

Cons

- Elevated Premiums: Transamerica’s supplemental health insurance may entail relatively higher costs.

- Restricted Access: Some demographics may face limitations in accessing Transamerica’s policies.

#3 – Elephant: Best for Tailored Plans

Pros

- Extensive Coverage: According to our Elephant insurance review, Elephant provides supplementary health insurance as part of its diverse product offerings.

- Convenient Online Tools: Elephant offers easy-to-use online account management and bill payment features, adding to customer convenience.

- Reputable Brand: Elephant’s well-established brand reputation may inspire trust among individuals seeking supplementary health insurance.

Cons

- Informational Limitations: Elephant provides insufficient details about their supplementary health insurance policies.

- Focused Online Marketing: Elephant’s targeted online advertising approach may raise privacy apprehensions for certain customers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Allstate: Best for Customer Care

Pros

- Outstanding Claims Processing: As per our Allstate insurance review, they demonstrate exceptional proficiency in managing claims, crucial for dependable health insurance.

- Customer-Focused: Allstate places a high priority on ensuring customer satisfaction, as evidenced by positive feedback and dedicated client support.

- Affordable: Allstate presents competitive pricing, offering the prospect of cost savings for those seeking supplemental health insurance.

Cons

- Restricted Accessibility: Allstate’s operations are confined to specific states, limiting accessibility for individuals seeking supplemental health insurance outside those regions.

- Absence of Allstate Certification: The lack of participation in the certification program raises concerns regarding recognition within the insurance industry.

#5 – Cigna: Best for Specialized Policies

Pros

- Superior Customer Support: Cigna is well-known for its outstanding customer service, consistently receiving high rankings in satisfaction surveys and offering tailored assistance.

- Attractive Pricing: Cigna offers competitive rates across various insurance types, including auto, home, and life insurance, complemented by member discounts.

- Membership Perks: Cigna provides exclusive benefits such as financial planning services and discounts on a wide array of products and services.

Cons

- Restricted Membership: Enrollment is limited to military personnel and eligible family members.

- Availability Limitations: Our assessment in the Cigna insurance review indicates that not all insurance products may be accessible in every served location.

#6 – MetLife: Best for Coverage Options

Pros

- Robust Financial Standing: The A rating from A.M. Best for the MetLife insurance group guarantees a high level of financial stability.

- Embracing Diversity: MetLife’s dedication to diversity ensures inclusivity in their coverage offerings.

- Strong Customer Loyalty: With a retention rate exceeding 90%, MetLife is a preferred choice among policyholders.

Cons

- Narrow Insurance Scope: MetLife might provide a limited range of options for supplemental health insurance.

- Agent Accessibility: As indicated in our MetLife insurance review, access to agents may be restricted in specific geographic areas.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – Humana: Best for Wellness Programs

Pros

- Superior Whole Life Protection: Humana offers top-notch Aetna Medicare supplemental health insurance plans, ensuring long-term financial stability.

- Exceptional Service: Renowned for its outstanding customer support, Humana insurance agents provide personalized assistance, enhancing overall satisfaction.

- Community Engagement: Humana insurance actively contributes to community well-being, earning favor among socially conscious customers.

Cons

- Limited Availability: According to our Humana insurance review, their services may have geographical limitations, posing challenges for individuals residing outside their operational areas.

- Price Fluctuations: While comprehensive, Humana insurance’s pricing may not consistently be the most competitive, prompting cost-conscious customers to consider alternative options.

#8 – Costco: Best for Member Benefits

Pros

- Cost-Effective Pricing: Costco insurance provides the opportunity for potential annual savings compared to conventional health insurance options.

- Customized Coverage: Policies are adaptable to accommodate individual needs and preferences.

- Convenient Mobile App Features: The Costco app offers functionalities such as trip monitoring, car health diagnostics, and alerts for street sweeping.

Cons

- Limitations: As per our assessment in the Costco insurance review, certain restrictions may pose inconvenience to some users.

- Restricted Availability: The services are presently limited to specific states, potentially excluding customers residing elsewhere.

Aetna Medicare Supplemental Plans

Aetna provides four Medicare Advantage plans, but it’s important to grasp Original Medicare first. This covers hospital care (Part A) and outpatient services (Part B). Medicare Advantage plans offer additional benefits, such as dental coverage.

Aetna’s options include HMOs, HMO-POS, PPOs, and Dual Special Needs Plans. They offer guidance with Medicare and Medicaid and primarily focus on group insurance plans, not individual coverage. (Read our full “A Complete Guide to Aetna Senior Products” for more information).

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost of Aetna Insurance

Aetna Health Insurance Reviews

Getting Quotes and File Claims

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Buying Aetna Supplemental Insurance?

Aetna’s supplemental insurance plans offer affordable options to reduce Medicare-related costs, often with lower rates than competitors. Despite this, Aetna receives more customer complaints than average, suggesting potential trade-offs for affordability.

Consider Aetna's supplemental insurance for affordable Medicare cost reduction, but note higher complaint rates, possibly indicating trade-offs for affordability.Ty Stewart Licensed Insurance Agent

They offer only Plans A, B, F, G, and N, and coverage is not available in all states. Use our free quote comparison tool to explore similar plans or life insurance from other providers in your area by entering your ZIP code.

Case Studies: Aetna Medicare Supplement Plans and Insurance Options

Explore the dynamic relationship between affordability and customer satisfaction in Aetna’s Medicare supplement plans through our series of case studies.

- Case Study 1 – Customer Complaints vs. Affordable Rates: Aetna’s Medigap plans cover Medicare costs, but despite affordability, they face more customer complaints. This study delves into the balance between rates and satisfaction.

- Case Study 2 – Obtaining Quotes and Filing Claims: This case study details how to get quotes for Aetna’s supplemental insurance and explains the claim filing process, offering insights for potential policyholders.

- Case Study 3 – Contacting Aetna for Information and Assistance: This case study provides contact options for Aetna’s supplemental insurance, including phone, email, and mailing address, ensuring easy access for customers seeking assistance.

- Case Study 4 – Considerations for Purchasing: This case study explores factors to consider when purchasing Aetna’s supplemental insurance, noting its affordability and limited availability of specific plans across states.

Find the Best Medicare Advantage Plan for Your Needs

Frequently Asked Questions

What does Aetna’s Medicare supplement plans cover?

How much does Aetna Supplemental Insurance cost?

Aetna offers competitive rates compared to other companies. For more details, you can compare rates and see the accuracy of the insurance quotes.

How is Aetna rated?

Aetna has an A+ BBB rating but receives more customer complaints than average.

How do I get quotes or file claims with Aetna?

Get quotes online; healthcare providers handle claims. Start comparing now by entering your ZIP code for your convenience.

How can I contact Aetna?

Call their customer service department or use their email/mailing address. See other ways through different reviews like life insurance company review.

What are Aetna Medicare supplemental plans?

Aetna Medicare supplemental plans, also known as Medigap plans, help cover costs not paid by Original Medicare, such as copayments, coinsurance, and deductibles.

How much does Aetna insurance cost?

The cost of Aetna insurance can range widely based on factors such as the type of plan chosen, coverage levels, age, location, and any additional benefits or riders selected. It’s best to request a personalized quote from Aetna to get an accurate estimate tailored to your specific needs and circumstances. Enter your ZIP code now.

How do I get quotes or file claims?

You can get quotes for Aetna insurance plans by visiting their website or contacting them directly. Also, we can see reviews like the occidental life insurance review. To file claims, you can typically do so online, through the Aetna mobile app, or by contacting their customer service team by phone.

Should I buy Aetna supplemental plans?

What are the key features for the Aetna Medicare supplemet?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.